Amazon is a multinational business enterprise that sells multiple matters on this online platform. At the start, it best offered books on its websites but as time passed it started to provide digital devices, clothes, household items, top movies, and lots more. Today it’s miles one of the largest organizations in the global.

Amazon.Com, Inc. (AMZN) has dominated e-commerce, cloud computing, and digital streaming for years. Investors love the corporation for its particular business approach, purchaser-centric attitude, and consistent improvement into new areas. Thus, many surprise approximately Amazon stock’s future.

This weblog article will analyze Amazon inventory rate projections for 2024, 2025, 2030, 2040, and 2050, in addition to income, expert estimates, and bull and bear justifications for investing in Amazon.

Amazon’s change commenced via Jeff Bezos on July 5, 1994, and at the start, its call changed to “Cadabra” However the call turned into soon changed to Amazon Inc. The company started in Bezos’ garage in Bellevue, Washington, and launched its website in 1995, promoting books online. In 1996, Amazon’s revenue doubled using the give up of the 12 months. After increasing past books in 1998, Amazon made its first income in overdue 2001. By 2003, it became profitable, beginning its adventure to become the worldwide giant it is today.

The principal regions of hobby are e-trade, cloud computing, digital streaming, and artificial intelligence. Today, the organization gives diverse goods and services, which include Amazon Prime, Web Services (AWS), Music, and Prime Video.

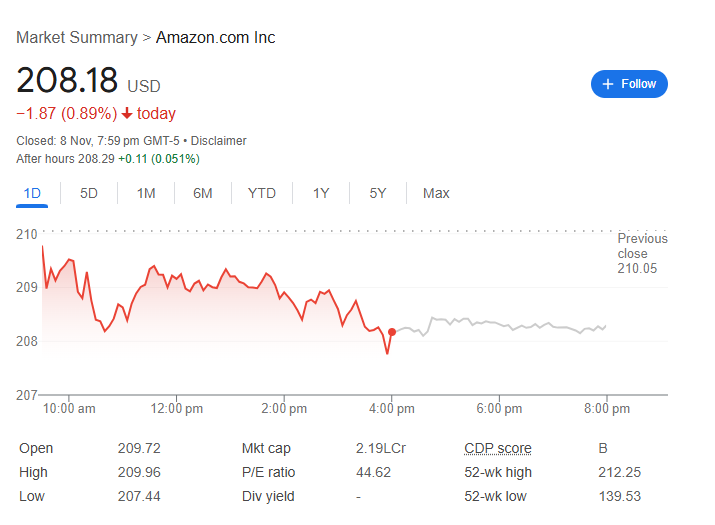

The fee has given a breakout from its resistance degree of $196 and is trading at $197.9. From eleven September to 30 October, it changed into stuck at the range however sooner or later, on the start of November, it gave a breakout. But the exciting element is that the breakout candle does not have a great deal energy and for a safe exchange you should watch for the first half of of the subsequent buying and selling consultation and then execute consistent with your approach and evaluation.

Amazon Stock Price Prediction 2024

The organization is appearing well, and it’s far experiencing many tendencies. Financially, It exceeded Wall Street expectations in its 0.33-area income document, displaying sturdy sales and higher-than-anticipated earnings in keeping with percentage. On the retail aspect, it optimizes grocery fulfilment and gives greater convenience to Prime contributors. So in 2024, its share fee could be $215.

Amazon’s stock charge will rely upon its ability to dominate the e-trade and cloud computing corporations, enlarge its subscription offerings, and enhance the global economic system. As in line with our experts, its percentage price might be among $one hundred forty four and $215.

Amazon Stock Price Prediction 2025

| Month | Minimum Price (Rs) | Maximum Price (Rs) |

| January | $201 | $214 |

| February | $200.50 | $224 |

| March | $201.60 | $227 |

| April | $202.40 | $228 |

| May | $203.40 | $236 |

| June | $203.98 | $238 |

| July | $204.5 | $245 |

| August | $205 | $253 |

| September | $205.5 | $264 |

| October | $206.8 | $270 |

| November | $207 | $272 |

| December | $208 | $290 |

The enterprise is improving its services like Prime membership blessings with fuel reductions. It is expanding its Prime Video content material with the aid of including Apple TV to its platform. Also as in keeping with the modern marketplace condition, it continues to innovate, especially in AI and power sectors as AI will play a essential role in its business. So via 2025, its percentage charge could be $290 as in step with our analysis.

It develops into e-commerce, cloud computing, and digital streaming. The company’s AI, robotics, and healthcare efforts can also improve boom.

In 2025, its share fee might be among $201 to $290.

Stock Price Prediction 2026

| Month | Minimum Price (Rs) | Maximum Price (Rs) |

| January | $220 | $226 |

| February | $222 | $234 |

| March | $223 | $245 |

| April | $224 | $254 |

| May | $221 | $260 |

| June | $224 | $267 |

| July | $226 | $280 |

| August | $227 | $321 |

| September | $228 | $342 |

| October | $229 | $350 |

| November | $230 | $358 |

| December | $233 | $388 |

Over the ultimate ten years, this employer has grown plenty, specially in the course of the pandemic time because that point an increasing number of humans shopped online which assist a whole lot to this corporation. They do a number of commercial enterprise of their app like paying bill payments, reserving tickets and also high movies. For the destiny, they had many plans to execute which would be tons useful for the corporation. So by using 2026, its share rate could be $388 as in keeping with our deep evaluation.

By the year 2026, its percentage charge might be between $220 to $388 as per our evaluation.

Stock Price Prediction 2030

| Month | Minimum Price (Rs) | Maximum Price (Rs) |

| January | $611 | $622 |

| February | $618 | $629 |

| March | $623 | $632 |

| April | $630 | $644 |

| May | $640 | $652 |

| June | $646 | $665 |

| July | $651 | $674 |

| August | $660 | $680 |

| September | $688 | $712 |

| October | $704 | $740 |

| November | $736 | $758 |

| December | $769 | $785 |

It has grown a lot in exclusive areas, but it’s now going through extra opposition and challenges. During the pandemic, e-trade income hit document highs. But this turned noticed through all different online competitors who tried to conquer this corporation and on occasion, it was given losses as it has a strong financial popularity it managed U. S.A.And downs, but for the future, it needed to be geared up for the big changes; additionally, they may be running on it. So by way of the year 2030, its proportion fee could be $785, as anticipated by our professionals.

Amazon must be a first-rate participant in e-commerce, cloud computing, digital streaming, healthcare, and logistics by 2030. Innovation and customer pleasure increase boom for the company.

In 2030, we are able to see its percentage rate between $611 to $785, as in keeping with our expert’s advice.

Stock Price Prediction 2040

The employer has more than one agencies besides selling goods in its app. Its cloud offerings are predicted to hold developing progressively, and its advertising business is anticipated to perform even better over the years with greater commercials being offered through its streaming offerings. This may want to assist improve the company’s standard growth and stock performance. In 2040, its proportion price would be $1321 as in line with our analysis.

Amazon’s inventory price might upward push even extra via 2040 because the company becomes a international powerhouse. The employer’s AI, robotics, and deliver chain management abilities may also increase lengthy-term improvement.

In 2040, its share charge might be between $1175 to $1321.

| Month | Minimum Price (Rs) | Maximum Price (Rs) |

| January | $1175 | $1187 |

| February | $1180 | $1193 |

| March | $1186 | $1204 |

| April | $1194 | $1221 |

| May | $1206 | $1229 |

| June | $1213 | $1236 |

| July | $1227 | $1240 |

| August | $1234 | $1257 |

| September | $1245 | $1273 |

| October | $1250 | $1280 |

| November | $1264 | $1300 |

| December | $1289 | $1321 |

Stock Price Prediction 2050

The company is working on a few regions for destiny improvement. The employer is making a very good quantity of investment in synthetic intelligence to compete higher. In e-trade, Amazon is putting numerous cash into keeping its role, even if it approach less income for now. They assume that improvements in how they cope with logistics and using robots in warehouses will assist them earn more money afterward. The advertising a part of the commercial enterprise is also developing quick, with sturdy boom expected. Overall, by way of that specialize in those areas and investing in new initiatives in destiny. So by means of the year 2050, its percentage fee would be $2110.

Amazon is probably a multi-trillion-dollar firm imparting goods and services in several sectors by 2050. Long-time period success may depend on the organization’s potential to react to market and customer adjustments.

By 2050, its percentage price would be between $1910 to $2110 as in keeping with our professional group.

Financial analysts and industry specialists generally tend to love Amazon stock. Many count on the organisation’s robust function in lots of industries and potential to innovate and adapt to moving consumer tastes to generate long-time period increase.

Should I Buy Amazon Stock ?

It is one of the sturdy online platforms which is known globally. At Gift, that is one of the strongest corporations within the international. At the start, they provided only online books but now you may purchase, and promote merchandise, pay bills, e-book tickets, Prime movies, and more.

The business enterprise had achieved thoroughly inside the past and that they had many plans which might increase the corporation.

The organization has grown and innovated but need to address issues, which includes growing opposition in e-commerce and cloud computing, regulatory troubles, and stock marketplace volatility.

Amazon’s e-trade, cloud computing, and digital streaming leadership has recently fueled high earnings. The employer’s inventory success is because of sustained revenue increase and high income margins.

Bull Case:

- It is a pacesetter in online shopping, it gave hard competition to its competition.

- Amazon Web Services (AWS) is a pinnacle participant in cloud computing.

- It makes money from various assets, like marketing and subscription offerings (e.G., Prime), which helps reduce dangers.

- It invests in new generation, like AI and better shipping systems, which could result in extra performance and increase.

- Many clients maintain coming back to Amazon, using constant sales.

Bear Case:

- There are worries approximately government guidelines that might limit operations or lead to fines.

- Costs for labour and delivery are going up daily.

Conclusion on Amazon Stock Price Prediction

In this Post, Detail examines approximately AMAZON inventory. The organization does multiple enterprises and plans to extend in the future. Amazon.Com, Inc. (AMZN) has led the e-commerce, cloud computing, and digital streaming sectors for years, and its stock has accomplished properly. Amazon’s sturdy market role, purchaser-centric mindset, and ability to innovate imply that it can continue to do nicely ultimately. Investors have to weigh their monetary objectives and risk tolerance earlier than investing.

1 thought on “Amazon Stock Price Prediction 2025, 2030, 2040, 2050”